Category: Uncategorised

Understanding Stakeholder Engagement and Collaboration in Scotland’s City Region Deals

15th June 2023

Regional Economic Growth Through Innovation Policy and Business Engagement: Evidence from Three UK City Regions

Supporting the development of a Social and Environmental Impact Assessment at Innovate UK

1st June 2023

New report and podcast: Skills, Innovation, and Productivity – The Role of Further Education in Local and Regional Ecosystems

23rd March 2023Archives

- June 2023

- May 2023

- April 2023

- March 2023

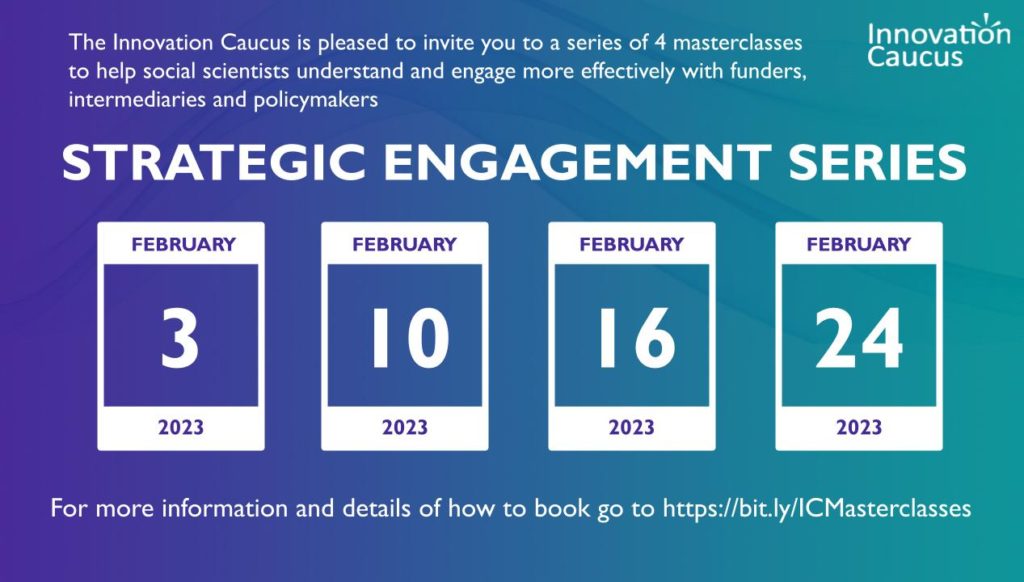

- February 2023

- December 2022

- November 2022

- October 2022

- June 2022

- March 2022

- January 2022

- October 2021

- June 2021

- March 2021

- January 2021

- October 2020

- September 2020

- June 2020

- April 2020

- February 2020

- December 2019

- November 2019

- October 2019

- September 2019

- June 2019

- May 2019

- April 2019

- March 2019

- January 2019

- October 2018